accontancy depreciation

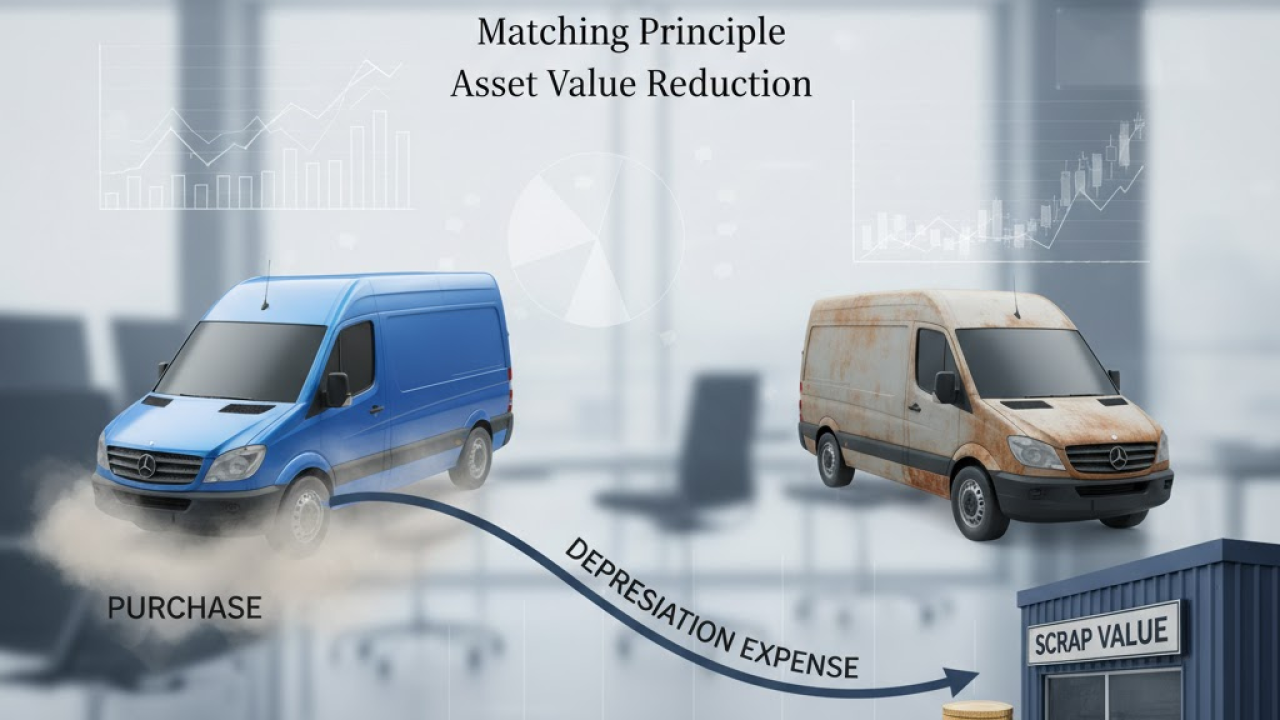

. Accurate Financial Reporting Objective: Ensure that financial statements accurately reflect the company's financial position Matching Principle Objective: Align expenses with the revenues they help generate during the same period . Compliance with Regulations Objective: Follow accounting standards like GAAP or IFRS to ensure legal compliance. Cost Control Objective: Help businesses manage and reduce unnecessary costs. Profit Measurement Objective: Accurately measure and report profits or losses over a period. Asset Management Objective: Track and optimize the use of company assets. Options: Cash Flow Management Objective: Ensure sufficient liquidity to meet financial obligations and operations. Options: Tax Reporting Objective: Accurately report income and expenses to meet tax obligations Budgeting and Forecasting Objective: Plan for future income and expenditures to ensure business growth. Internal Controls Objective: Establish systems and procedures to safeguard company assets Revenue Recognition Objective: Recognize revenue when it is earned, not necessarily when cash is received. Financial Transparency Objective: Ensure that financial reports are clear and easily understood by stakeholders. Capital Structure Management Objective: Maintain an optimal balance of debt and equity to maximize company value. Liquidity Management Objective: Ensure the company has enough short-term assets to meet its liabilities. Expense Control Objective: Monitor and reduce unnecessary expenses to maximize profitability. Depreciation Management Objective: Allocate the cost of long-term assets over their useful life to ensure accurate financial reporting. Risk Assessment Objective: Identify financial risks and develop strategies to mitigate them. Accounts Reconciliation Objective: Regularly reconcile accounts to ensure financial accuracy and prevent errors. Investment Appraisal Objective: Evaluate potential investments to ensure they align with business goals and generate returns.

To understate company assets

To provide financial data that misrepresents the company

o reflect the true financial position of the company

To minimize the reporting of liabilities

To report expenses before revenue

To match revenues with liabilities

To match expenses with revenue in the same period

To match revenues with capital expenditures

To follow personal preferences over standards

To comply with accounting laws and standards

To ignore government regulations

o minimize the amount of taxes owed

o increase operational costs

To help businesses control and minimize costs

To report higher costs to reduce profits

To ignore cost management strategies

o focus only on revenue without considering expenses

To calculate the company’s profits or losses correctly

To ignore profit and focus on growth

You said: and iska description likho one line me likhna You said: keyboard description likho ek hi line me You said: 100 word me jis releted se aap mujhe objective likhe the usi releted se description likho You said: isi releted se keyboard likho thoda Get smarter responses, upload f

To let assets depreciate rapidly

To maximize the value of assets through proper management

To ignore asset tracking

To sell all assets immediately

To ignore cash flow and focus on profits

To maintain healthy cash flow for business operations

To let cash flow be unpredictable

To deplete cash reserves rapidly

To reduce tax liabilities by any means

To misreport financial information for tax benefits

To follow tax laws and report accurately

To ignore tax laws and regulations

To ignore future financial planning

To create unrealistic financial projectio

To forecast only profits

To develop a realistic budget and forecast

To allow free access to company assets without control

To ignore the need for internal controls

To implement controls to protect against fraud and theft

To avoid checks and balances in operations

Recognize revenue when cash is received

Recognize revenue only at the end of the fiscal year

Recognize revenue when it is earned, regardless of cash flow

Ignore revenue recognition

Hide financial information to avoid scrutiny

Provide financial reports that are accurate and easily understood

Provide reports with excessive jargon

Only share financial information with the board

Rely only on debt financing

Avoid taking on any debt

Ignore capital structure management

Maintain a balanced and optimal capital structure

Ignore short-term liabilities

Only invest in long-term assets

Maintain sufficient liquidity to meet current obligations

Prioritize long-term investments over short-term liquidity

Control and minimize unnecessary expenses

Increase all operational costs

Ignore expense management

Only focus on revenue generation

Ignore depreciation on assets

Allocate depreciation over a random period

Accurately allocate depreciation to match asset usage

Depreciate assets faster than their actual wear and tear

Ignore financial risks

Identify and assess risks to develop mitigation strategies

Embrace all risks without caution

Only focus on operational risks

Skip account reconciliation to save time

Reconcile accounts periodically to ensure accuracy

Only reconcile accounts at year-end

oncile accounts only when errors are found

Invest blindly without proper evaluation

Ignore the potential return on investments

Invest only in high-risk ventures

valuate investments using financial metrics to assess potential returns